See This Report on Eb5 Immigrant Investor Program

Wiki Article

Not known Factual Statements About Eb5 Immigrant Investor Program

Table of ContentsTop Guidelines Of Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program Can Be Fun For AnyoneThe Of Eb5 Immigrant Investor ProgramEverything about Eb5 Immigrant Investor ProgramSome Known Factual Statements About Eb5 Immigrant Investor Program 8 Easy Facts About Eb5 Immigrant Investor Program Described

In spite of being less popular, other pathways to acquiring a Portugal Golden Visa consist of investments in equity capital or exclusive equity funds, existing or new company entities, capital transfers, and donations to sustain scientific, technological, artistic and cultural developments. Holders of a Portuguese resident permit can also function and study in the nation without the requirement of getting added authorizations.

The Main Principles Of Eb5 Immigrant Investor Program

Investors need to have both a successful business history and a considerable organization performance history in order to use. They may include their spouse and their youngsters under 21-years- old on their application for permanent home. Effective candidates will obtain a renewable five-year reentry authorization, which enables open travel in and out of Singapore.

Little Known Facts About Eb5 Immigrant Investor Program.

Applicants can spend $400,000 in government accepted realty that is resalable after 5 years. Or they can invest $200,000 in federal government authorized property that is resalable after 7 years. All while paying federal government fees. Or they can donate $150,000 to the federal government's Sustainable Growth Fund and pay minimal federal government costs.

This is the major advantage of immigrating to Switzerland compared to other high tax countries. In order to be eligible for the program, candidates must More than the age of 18 Not be utilized or occupied in Switzerland Not have Swiss citizenship, it needs to be their first time living in Switzerland Have actually rented or purchased home in Switzerland Supply a long list of identification papers, consisting of clean criminal record and good moral character It takes about after payment to acquire a resident license.

Tier 1 visa owners stay in status for regarding three years (depending on where the application was filed) and have to use to extend their stay if they desire to proceed living in the United Kingdom. The Rate 1 (Entrepreneur) Visa is legitimate for three years and 4 months, with the alternative to prolong the visa for an additional 2 years.

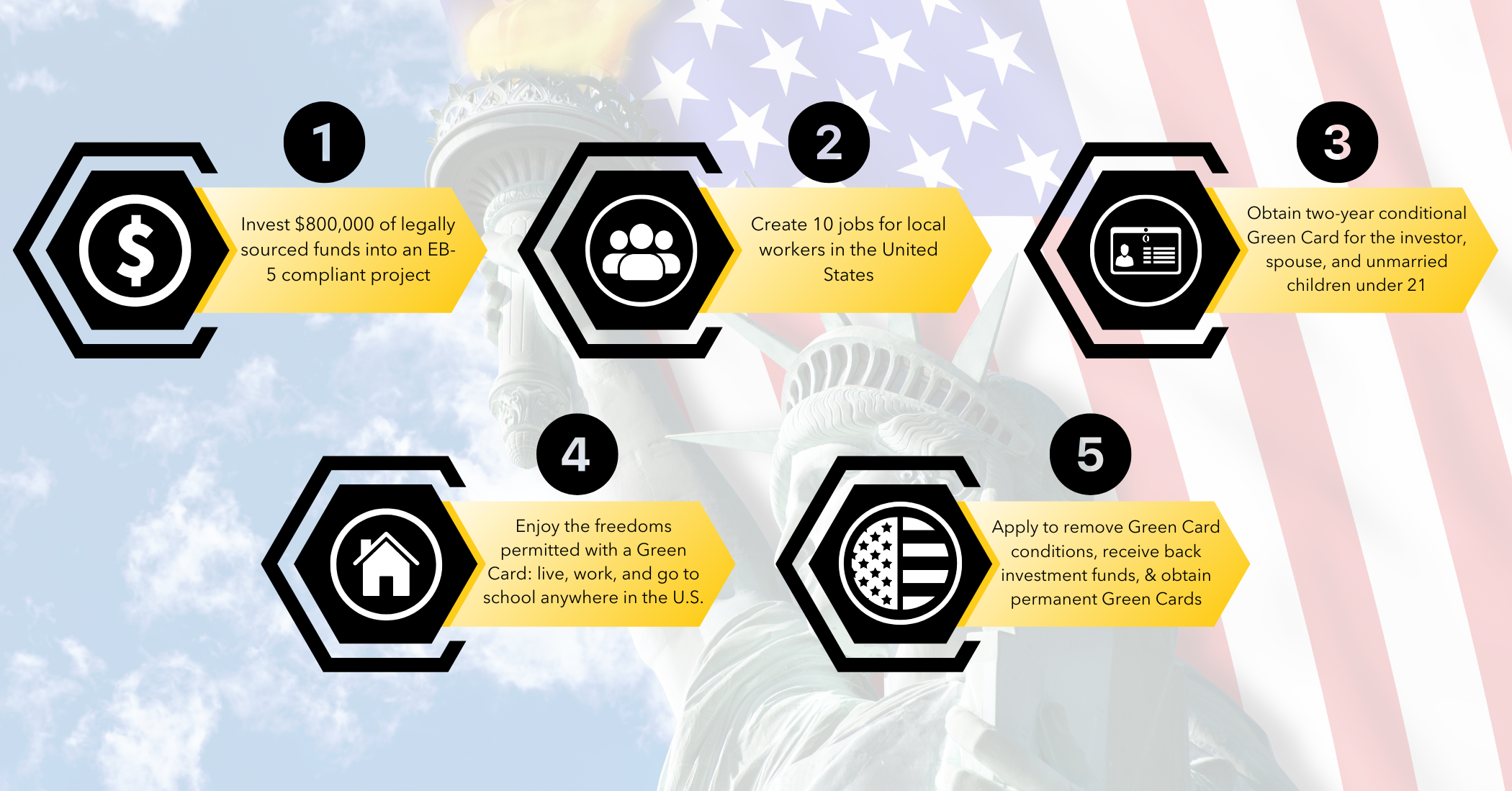

Financial investment immigration has actually been on an upward fad for greater than 20 years. The Immigrant Financier Program, also called the EB-5 Visa Program, was established by the united state Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its key purpose: to promote the united state economic situation with task development and capital expense by international financiers.

This included decreasing the minimal financial investment from $1 million to $500,000. With time, modifications have actually boosted the minimum financial investment to $800,000 in TEAs and $1.05 million in other locations. In 1992, Congress sought to increase the impact of the EB-5 program by introducing the Regional Facility Pilot Program. These privately-run entities were assigned to promote financial development and job creation within certain geographical and industry sectors.

Everything about Eb5 Immigrant Investor Program

Visas are "booked" each : 20% for rural, 10% for high joblessness, and 2% for framework. Unused books rollover to the next year. Designers in rural locations, high joblessness areas, and infrastructure tasks can profit from a specialized swimming pool of visas. Capitalists targeting these details locations have an increased likelihood of visa availability.Developers dealing with public works great post to read tasks can currently get EB-5 financing. Investors now have the possibility to spend in government-backed facilities projects. Specific USCIS analyses under prior law are secured by law, including forbidden redemption and financial obligation arrangements, and gifted and lent investment funds. Developers require to guarantee their investment arrangements adhere to the new statutory meanings that impact them under united state

migration law. EB5 Immigrant Investor Program. Financiers must know the accepted kinds of mutual fund and arrangements. The RIA has established requirements for concerns such as redeployment, unlike prior to in prior versions of the law. Financiers and their families currently lawfully in the united official statement state and eligible for a visa number might concurrently file applications for change of standing in addition to or while awaiting adjudication of the financier's I-526 petition.

This simplifies the procedure for capitalists currently in the United state, quickening their ability to readjust status and preventing consular visa processing. Capitalists looking for a quicker handling click here to find out more time could be extra likely to spend in rural jobs.

Not known Factual Statements About Eb5 Immigrant Investor Program

Trying to find U.S. federal government details and solutions?To qualify, applicants must invest in new or at-risk industrial business and create permanent positions for 10 certifying employees. The United state economy benefits most when an area is at threat and the new investor can supply a working facility with complete time work.

TEAs were carried out into the financier visa program to motivate investing in places with the best requirement. TEAs can be country locations or locations that experience high joblessness.

Report this wiki page